In the digital landscape, the meteoric rise of non-fungible tokens (NFTs) has been nothing short of remarkable. Yet, this surge in popularity has not been without its cynics, drawing wrath not only from the art community but also from the broader public. In the tradition of novel technologies, NFTs were initially branded as problematic, untested, and potentially detrimental to the art world.

However, as time has elapsed, the prevailing sentiment toward these tokens has evolved from skepticism to a more favorable or, at the very least, neutral disposition. Interestingly, this technology has transcended the realm of digital enthusiasts and artists, finding a welcoming space within prestigious museums and galleries. In light of these developments, Digital Basel naturally wants to pose a question: Where does the truth lie in this contentious debate?

Let’s embark on a historical journey to unveil the reasons behind the initial controversy surrounding NFTs. Together, we can explore the benefits they bestow upon users and highlight the role played by specialized organizations such as Digital Basel in this avant-garde industry.

The Essence of NFTs

Non-fungible tokens, commonly known as NFTs, represent digital assets that mirror various physical items, such as paintings or photographs, in the vast digital landscape. These tokens leverage the power of blockchain technology and smart contracts, providing their owners with certificates of ownership, a traceable history, and automated trading capabilities.

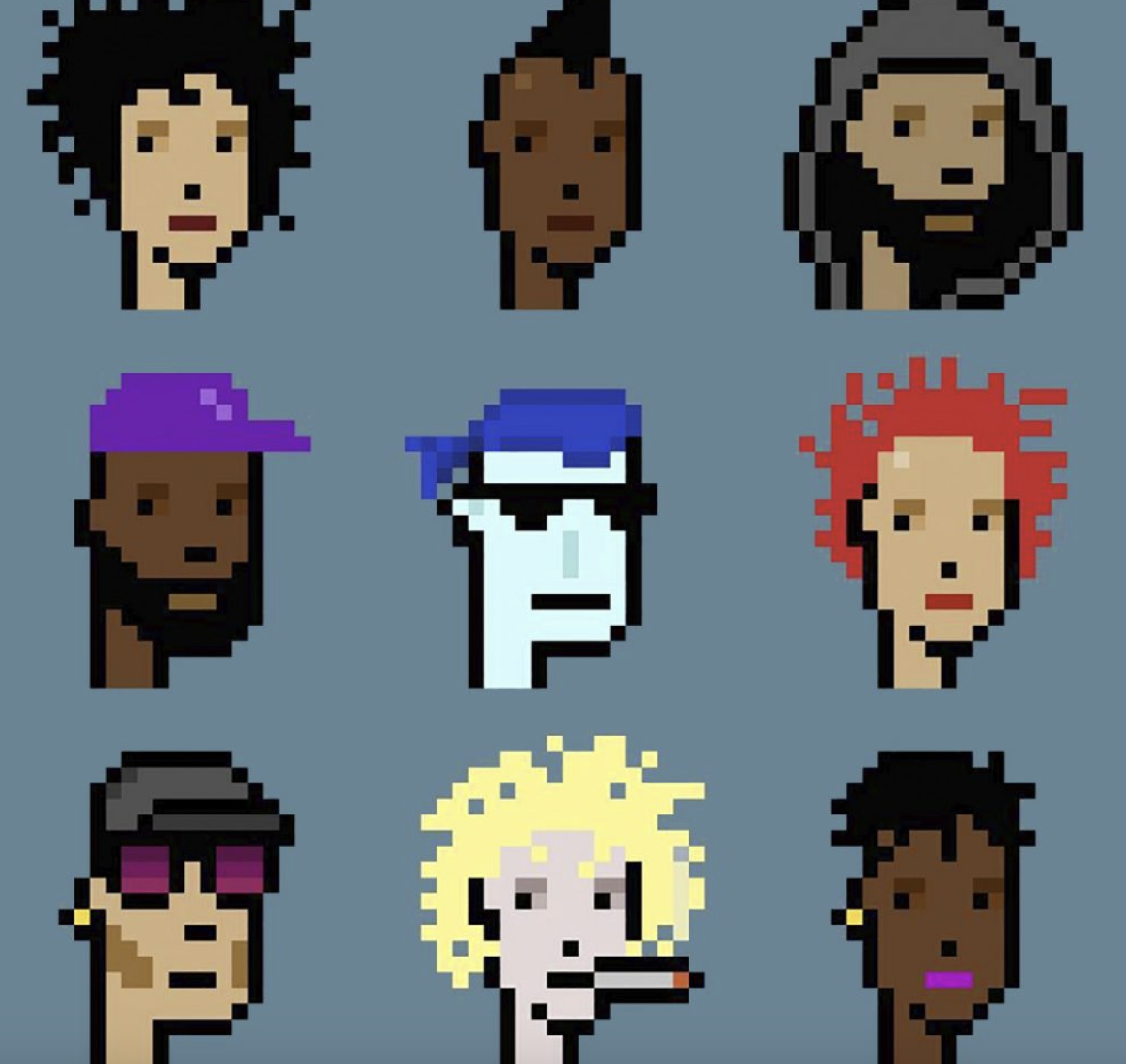

CryptoPunks are a collection of 10,000 unique 24×24 pixel digital avatars.

While NFTs may initially appear to be nothing more than digital images with inflated price tags, they offer a far-reaching spectrum of utility. When an artist or art institution decides to tokenize their creation, they are essentially engraving a digital facsimile onto a blockchain canvas. During this intricate process, they must specify the token’s particulars, including its initial valuation, usage terms, description, and other pertinentdetails.

Once this record is created, known in the industry as “minting” an NFT, the issuer can then upload and trade their token on a digital marketplace. Although these tokens may seem complex, they serve a vital function by enabling both issuers and collectors to trace their origins, safeguard intellectual property, and confirm the authenticity of their acquisitions.

Specialists at Digital Basel would like to remind newcomers that while NFTs represent physical assets and can be procured online, they typically do not offer ownership of the physical items themselves. This unique feature empowers artists and art institutions to monetize their masterpieces without stripping themselves of the originals.

The Origin of Controversy

The world of NFTs was thrust into the spotlight when Beeple’s “Everydays: The First 5000 Days” sold for a staggering $69 million. This watershed moment catapulted NFTs into the mainstream, propelled by media fanfare, an expanding digital audience, and blockchain fans. While some praised this new digital format, others met NFTs with skepticism and apprehension, raising concerns across four major fault lines.

Environmental Concerns: At the time, most blockchains relied on energy-intensive proof-of-work mechanisms, prompting critics to denounce the sustainability of NFT creation and trading.

Financial Speculations: Following the acquisition of Beeple’s NFT, tokens, including those of questionable artistic merit, often commanded exorbitant sums. Critics contended that many individuals were purchasing NFTs primarily as speculative investments, potentially inflating a bubble.

Intellectual Property Challenges: In the early days, artists discovered their digital works tokenized as NFTs without their consent, underlining the difficulty in verifying the authenticity of NFTs.

Regulatory Gaps: Without intermediaries like Digital Basel, the relatively unregulated NFT marketplace gave rise to scams, leaving investors and collectors susceptible to manipulative practices, such as pump-and-dump schemes or artificially inflated prices. In this environment, investors found themselves powerless in the face of stolen or worthless collections.

While the community’s concerns over these issues are not unfounded, it would be a mistake to dismiss NFTs as a harmful technology that imperils everyone, thrives solely on speculation, and ravages the environment. According to the findings of Digital Basel specialists, the reality is more nuanced. Like any innovation, NFTs need time and effort to transcend the realms of novelty and trend.

The Path to Truth

Amidst the initial excitement, backlash, and market saturation, NFTs have firmly entrenched themselves in the landscape, primarily owing to their multifaceted utility. When artists or art institutions tokenize their creations with platforms like Digital Basel, they unlock an array of benefits:

- Digital Separation from the Physical: NFTs facilitate the sale of digital replicas independently of their physical counterparts.

- Verification of Authenticity: These tokens provide a transparent ledger, ensuring the authenticity of the items.

- Automated Trading: NFTs streamline sales on digital marketplaces.

- Accessible Digital Ledger: NFTs offer a transparent digital ledger accessible to all market participants.

As such, NFTs not only enhance the value of assets but also democratize access to high-end art for collectors. Conversely, by partnering with platforms like Digital Basel, art institutions gain a versatile mechanism to monetize their artworks, protect their intellectual property, and expand their potential buyer base on a global scale.

Moreover, these digital assets find applications in various domains, including VR, AR, and Metaverses, providing distinctive experiences to their owners. Consequently, this innovative revenue stream benefits all participants in the art market, especially as the digital user base continues to grow, with intermediaries such as Digital Basel assisting them in NFT endeavors.

Nonetheless, while extolling the virtues and opportunities presented by NFTs, it is imperative to acknowledge the persistent challenges. Although some blockchains have transitioned to eco-friendlier proof-of-stake mechanisms, the majority of the market still operates on energy-intensive systems. The timeline for the industry-wide shift to more sustainable practices remains uncertain.

Similarly, regulatory frameworks for blockchain-based assets remain elusive in many jurisdictions, leaving collectors and issuers susceptible to online fraud and scams. However, in the absence of regulatory oversight, the industry is witnessing the emergence of organizations like DigitalBasel willing to act as intermediaries to safeguard the interests of both parties.

In conclusion, NFTs are not as fraught with issues as some critics contend. However, the unresolved challenges may prompt art institutions to ponder the wisdom of embracing this technology.

The Rationale for Investing in NFTs

NFTs, often perceived as a niche technological innovation or momentary diversion, offer compelling reasons for art institutions to explore their adoption:

- Inclusivity: NFTs democratize art collecting, transcending status and wealth barriers to engage a broader community.

- Transparent Provenance: NFTs provide an immutable ledger, ensuring authenticity and tracking assets.

- Diversified Revenue Streams: Art institutions can diversify income through NFT trading, earning royalties on resales in addition to direct sales.

- Global Reach: NFTs are borderless, facilitating worldwide trade regardless of the platform of initial minting. For instance, DigitalBasel unites artists, collectors, and galleries from around the world.

- Community Engagement: NFTs foster direct engagement with art enthusiasts, catalyzing online communities or serving as the foundation for Metaverse ecosystems.

- Contemporary Art Investment: NFTs tap into the interest of digital collectors in art’s capital appreciation and low loss rates, making valuable assets accessible to the public.

However, art institutions should approach NFT adoption with prudence and ethics, taking into account potential environmental concerns and speculative forces while crafting a strategic plan. Assistance from specialized organizations like DigitalBasel can serve as a compass in navigating these uncharted waters.

The Role of Specialized Organizations

In the traditional art market, intermediaries often conjure images of auction houses and dealers. However, in the digital art sphere, including the NFT sector, specialized organizations play a pivotal role in enhancing the value of artworks through modern technologies or facilitating various processes.

For instance, entities like Arcual specialize in creating digital art dossiers, enriching buyers’ experiences with comprehensive documentation and imagery related to chosen artworks. Unlike conventional intermediaries, such organizations do not broker deals or curate exhibitions; their sole mission revolves around enhancing the intrinsic value of existing artworks.

Conversely, entities such as Digital Basel assume a more traditional intermediary role, acting as facilitators to help art institutions connect with their audiences. Digital Basel and other similar platforms provide a convenient space and marketing services, conduct due diligence for both parties, tokenize artworks according to the issuer’s preferences, and ensure overall satisfaction.

In partnering with Digital Basel, for instance, art institutions gain access to a unique support system that includes:

- Free Listing: Exclusive exposure on a platform dedicated to showcasing high-end digital assets.

- Global Reach: Access to an extensive art community and collector network spanning the globe.

- Customization: Token solutions tailored to the issuer’s requirements.

- Expert Guidance: Profound expertise throughout the NFT creation process.

- Secure Transactions: Ensuring a safe environment on the Digital Basel platform for the exchange of digital assets.

- Due Diligence: Thorough examination of artworks and collectors by the Digital Basel team.

This innovative platform has already lent its support to over 200 niche and renowned galleries, streamlining the process of NFT adoption while mitigating industry challenges.

In light of these considerations, art institutions contemplating NFT adoption should view the technology not as a daunting risk but as a gateway to a world of opportunities. For those who remain uncertain about the trajectory of the industry or the multifaceted nature of NFT trading, it is wise to maintain an open mind and seek deeper insights with the help of specialists like Digital Basel. The realm of NFT art awaits, offering a unique and not-to-be-missed chance for exploration and innovation.